Digital transformation of oil and gas sectors: How to tap new value ecosystems

Prior to the recent turbulent and volatile geopolitical events, the global oil and gas markets had been in a gradual state of stagnation with barrel prices touching 30-year lows as recently as 2020, and upstream investment were hard to find in an industry already stricken by poor financial and structural health.

However, in North American markets for example, there are clear signs for optimism on the road ahead. According to the US Energy Information Administration (EIA), US crude oil production is forecasted to bounce back to pre-pandemic levels by 2023 – averaging 12.8 million barrels per day in 2023, which translates to a projected daily increase of another 500 thousand barrels per day on top of current year-on-year projections.

To serve these projections and, moreover, ensure resilience in an industry susceptible to high volatility, a fundamental transformation of the sector must take place. According to a 2020 McKinsey report, this means taking a strategic approach to enhancing connectivity across asset portfolios, as well as a completely overhauling operating models using new value opportunities afforded by emerging digital technologies.

The impact of 4G and 5G private networks in oil and gas industries

Cellular connectivity has the potential to rapidly transform industrial environments, not only for onshore facilities but also remote offshore facilities that are already currently serviced by fiber, satellite and microwave backhaul.

Today, there are several cellular network deployment options for oil and gas industry players looking to leverage the value proposition of emerging digital technologies, all based on high-performance 4G or 5G dedicated networks.

This includes:

- 4G/5G private networks owned and operated by the business with dedicated spectrum

- 4G/5G private networks owned and operated by the business with semi-licensed spectrum, such as the Citizens Broadband Radio Service (CBRS) spectrum in US markets

- 4G/5G semi-private networks co-operated by the business and the spectrum holder.

For oil and gas players operating in onshore or offshore US territories, one cost-effective way to test and adopt 3GPP standards-based private cellular networks is by using affordable and agile CBRS spectrum.

The primary benefits of CBRS spectrum are twofold. First, CBRS’s simplified radio frequency (RF) guidelines simplify the process of installation and deployment, without the need for specialized expertise. Secondly, it also enables business owners to deploy a fully private network quickly, without need for provider involvement, as well as to deploy, move and scale new technology use cases with unprecedented flexibility and agility.

Connecting energy and digital innovation ecosystems at the edge

5G cellular connectivity options also feature cloud and edge computing that offer immediate and powerful processing capabilities that can be used by high-volume and immensely mobile applications, such as sensors and drones that can be operated remotely or even autonomously.

Edge computing shifts the availability of compute and storage resources for networked applications closer to end users and mobile devices, allowing companies to move compute capabilities into the network, keep more data on premises, and minimize data transfer and latency. It opens new pathways for leading hyperscale cloud providers into new industrial spaces, from which the energy industry can benefit significantly.

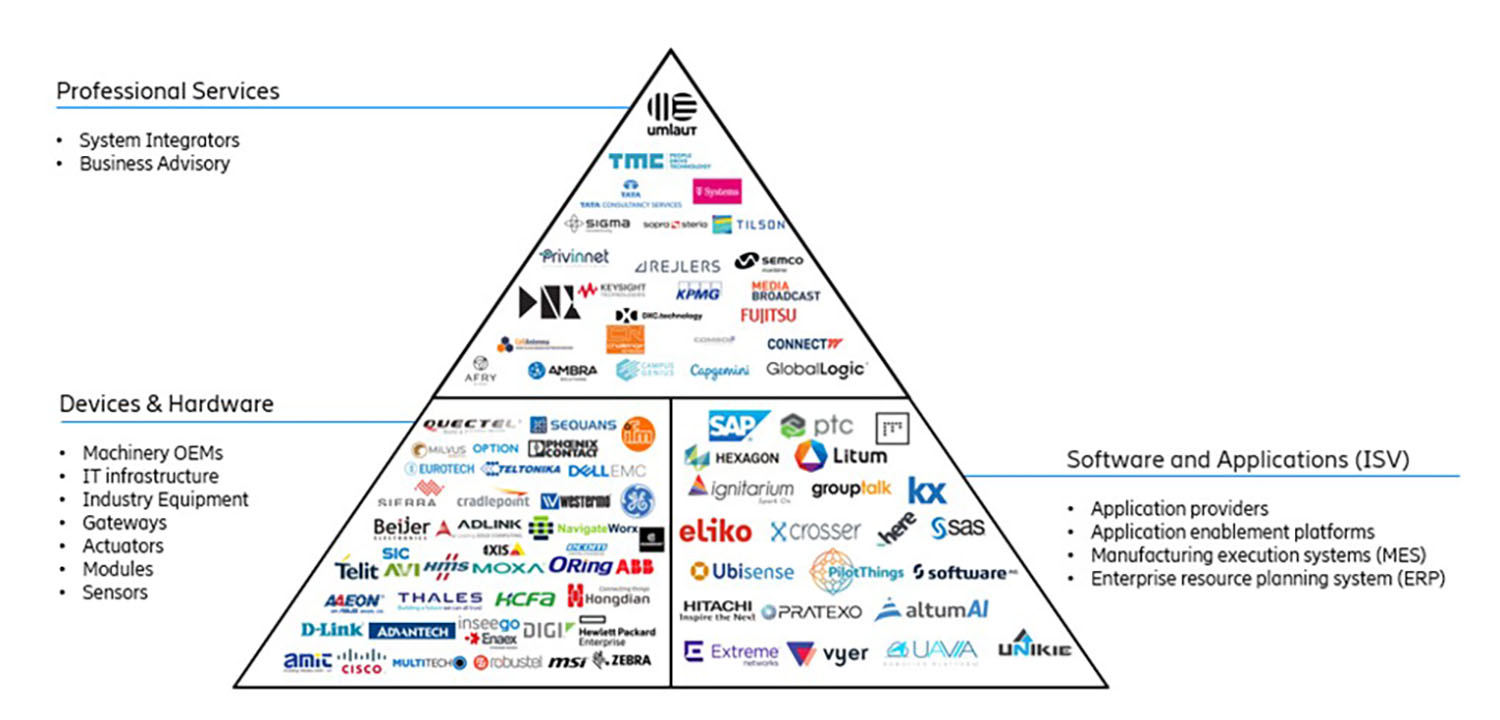

5G deployments for Industry 4.0 use cases, including those combining high-performance connectivity and edge compute, run on an extremely large engine made up of different cogs. Each cog represents a different technology platform or digital service which will inevitably vary depending on a company’s operating model and business delivery criteria—from connectivity infrastructures to operating systems and cloud platforms, and app services to original equipment manufacturers (OEMs). Thus, the ideal network roll-out is unique for each company and circumstance, one that will ultimately differentiate each business- and operating model, and be key to delivering long-term and sustainable economic growth.

Ericsson’s Industry 4.0 ecosystem partners

Understanding the value of new ecosystems

The arrival of industrial 5G is fundamentally changing the nature of technology partnerships across industries, merging traditional oil and gas companies deeper than ever into ecosystems comprising of connectivity providers, hyperscale cloud and compute providers and industry-specific OEMs.

However, where new doors are opened, new questions must also be considered. For oil and gas players undertaking their Industry 4.0 journey, this raises many critical questions about the choices of network technology, upgrade paths, migration devices, certification, data and security, edge cloud computing, artificial intelligence (AI), automation and analytics platforms, and many technology choices which will likely raise further questions regarding personnel models, impacting talent acquisition and upskilling.

The only way for oil and gas to solve such challenges – as well as reduce the cost, complexity and risk – is to work collaboratively and extensively with ecosystem partners, leveraging the full spectrum of expertise. A good example of this is Shell’s participation in the Open AI Energy Initiative taking place with partners across both energy and technology sectors. Cross-sectoral initiatives such as this will be critical to unlocking the transformational value of disruptive technologies in coming years. This will enable and accelerate innovation, agility, and reduce time to market of new services and solutions. Success depends on thinking strategically about combining the right partners and strengths across the value chain and forming ecosystems of varying sectors and customers.

Creating new value in oil and gas

Learn why private cellular networks are the only platform fit for the job.

Read the article

Ensuring the pieces fit: The importance of open standards and interoperability

As digitalization trends converge, the oil and gas ecosystem will be populated with more technologies, services and providers than ever before. The good news is that standardized cellular technology lends itself to the creation of a wider ecosystem where small and big partners can come together to offer a wider variety of solutions – unlike other solutions it doesn’t lock businesses in and has a multiplier effect. That’s because the technologies themselves are based on best-in-class open standards developed by a consensus of leading technology and industrial stakeholders. The alternative is a non-standards proprietary solution developed in a ‘closed’ environment with limited to non-existent opportunities for integration or scale.

Open ecosystems and a plug-and-play models enable ‘best of breed’ solutions to be forged, minimizing use case fragmentation. It has long been recognized that device fragmentation in terms of standards and a lack of interoperability constitutes a primary inhibitor of IoT adoption. Validation – or pre-integration – of devices on a network platform is one of the biggest benefits of an ecosystem. With a plug and play solution, companies can achieve faster deployment by having pre-integrated systems, while also increasing security with security validations being performed between partners.

In this regard, system integrators will play a decisive role, enabling seamless integration of the wider digital architecture, including network infrastructure, backend applications needed to do predictive modelling and analysis, and devices. With such a diverse range of integrators, in terms of portfolios and skills sets, having a list of skilled integrators ready and available is invaluable, allowing companies to quickly find the right system integrator for the specific job.

Accelerating innovation through OEM partnerships

5G provides a global platform for innovation. However, to unleash the full scale of the platform’s potential requires a mature IoT application ecosystem. For example, oil and gas industries will play a key role in accelerating the pace of this transformation by establishing direct partnerships within these ecosystems, enabling OEMs to understand unique challenges within the vertical and meet the unique certification requirements of the industry.

As we move deeper into 5G, Advanced 5G and even 6G in coming years, the volume and capabilities of connected devices will shift dramatically – supported by integrated SIM, improved batteries and developments within AI, and network and edge computing.

Looking ahead: changes in the next decade

LTE and 5G networks have become the base standard for industrial connectivity, with everything else becoming an endpoint beyond the network, both within the industry and within the different protocols and technologies that are being used. A strong and secure primary network is needed as a foundation to empower the most exciting and value-creating use cases — and a private cellular network is perfect for the job.

Learn more

At Ericsson, we take our experience and extensive portfolio, extending it horizontally while also working across other industries such as mining, manufacturing, and healthcare. We can connect the smallest to the most advanced use case, by bringing niche cases to our extensive partnership table and determining how to execute different collaborations successfully.

Discover how we are helping oil and gas and alternative energy companies overcome connectivity challenges with private network solutions using LTE and 5G. Our ecosystem includes a wide range of industrial partners, enabling us to address our oil and gas customers’ unique issues.

Ericsson Industry 4.0 ecosystem

Discover why 5G is the future of the oil and gas industry

Private networks as a platform for digital transformation in the oil and gas industry

RELATED CONTENT

Like what you’re reading? Please sign up for email updates on your favorite topics.

Subscribe nowAt the Ericsson Blog, we provide insight to make complex ideas on technology, innovation and business simple.